Free resources for Credit, Debt & Small Business

My goal for the past 20+ years has been to help individuals find reliable answers to their credit and financing questions. Helping consumers and small business owners cut through confusion and get the information they need to make better decisions is what drives me as a writer, speaker and educator.

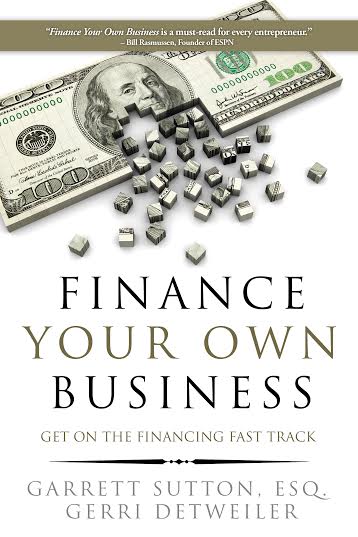

GET MY BOOK Finance Your Own Business For FREE

Pick up a copy of my book Finance Your Own Business: Get On The Financing Fast Track written with small business attorney and Rich Dad Advisor Garrett Sutton for free here.

What's New

-

The 12 Best AI Tools for Small Businesses and How to Use Them

Feb 13, 24 09:00 AM

Tools business owners are using right now to save a ton of time -

This Money Expert’s First Credit Card Landed Her in Debt. Here’s What She Learned

Jan 19, 24 09:00 AM

My first credit card got me in debt with little to show for it. Here's what I learned. -

Funding Options for Small Business: What You Need to Know

Nov 13, 23 03:00 PM

Funding Options for Small Business: Here I was interviewed about small business loans and other financing options.